Why Yield Farming, NFT Management, and Transaction History Matter More Than Ever on Solana

Man, I was just poking around my crypto portfolio the other day when I realized something: managing yield farming strategies, NFTs, and keeping track of transaction history isn’t just a side hustle anymore—it’s becoming the core of how we interact with DeFi on Solana. Wow! Seriously, it’s like the ecosystem has grown so fast that if you aren’t on top of these three things, you’re basically asking for trouble.

At first, I thought yield farming was just another buzzword, you know? But then I dug deeper and realized it’s more like a living, breathing beast that demands constant attention. NFTs? They’re not just digital art anymore; they’re staking assets, identity keys, and even tickets to exclusive events. And transaction history? Don’t get me started—it’s the backbone of your portfolio’s story, your proof of actions, and sometimes your best defense against mistakes or hacks.

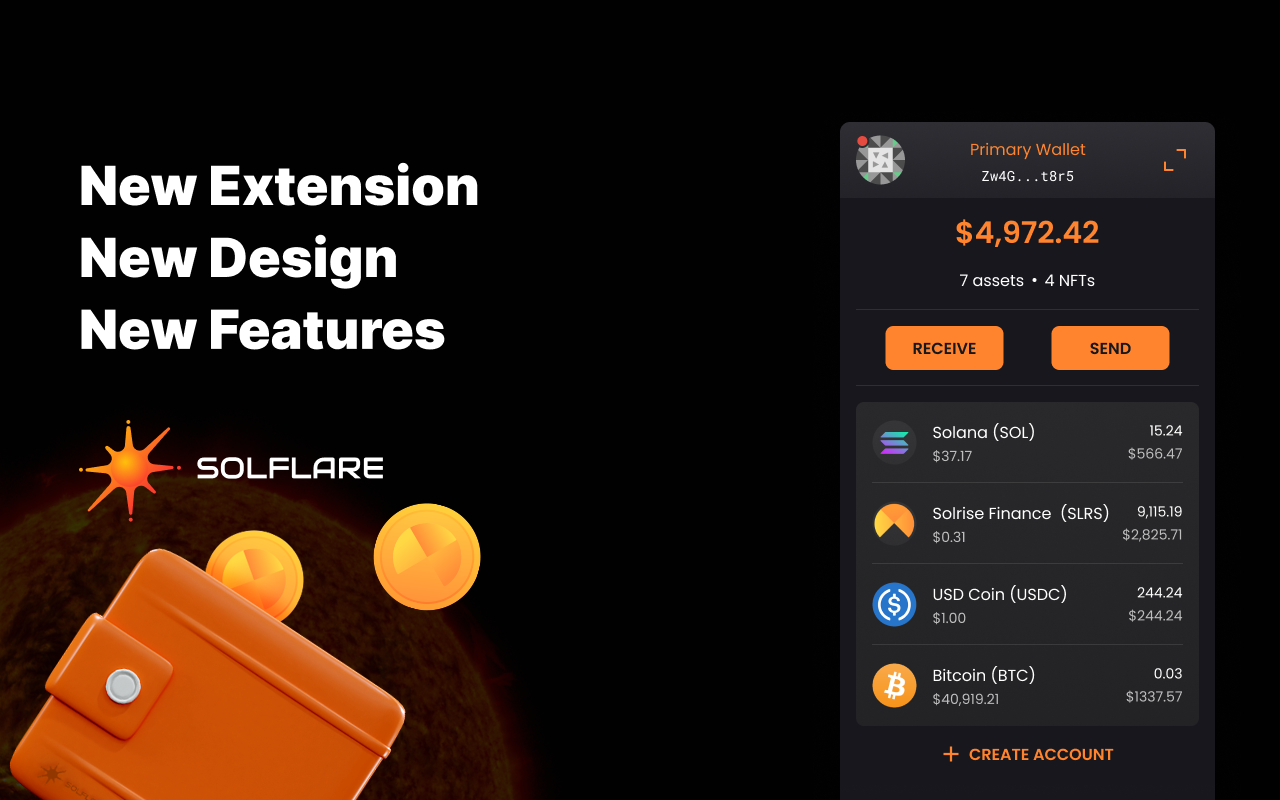

Okay, so check this out—there’s this wallet extension I’ve been using lately called solflare. It’s been a game changer for juggling all these moving parts on Solana. I mean, it’s one thing to hold assets, but it’s a whole other ballgame to manage yield farming pools, track NFT ownership, and see your transaction history in a clear, intuitive way.

Here’s the thing. Yield farming on Solana is slicker and faster than on some other chains, but that speed can also be a double-edged sword. If you’re not watching your positions or fees closely, you might get burned without even realizing it. Something felt off about some platforms promising crazy returns but ignoring transparency, so I got real picky about where I farm my yields.

And yeah, NFTs are wild. I’m not just talking about pixelated apes here—think about NFTs that generate passive income or those tied to real-world assets. Managing those through a wallet that supports seamless interaction is super crucial, otherwise, it’s like juggling flaming torches blindfolded.

Yield Farming: More Than Just Passive Income

So, yield farming on Solana is tempting because it promises a way to earn passive income by providing liquidity or staking tokens. But here’s the catch—it requires active management. I initially thought I could just lock my SOL or SPL tokens in a pool and chill. Nope. The DeFi space moves very very fast. Pools change, APYs fluctuate, and sometimes impermanent loss sneaks up on you. My instinct said to keep a close eye—otherwise, you can lose more than you gain.

Plus, there’s the matter of fees. Solana’s low fees make it perfect for yield farming compared to Ethereum, but if you’re hopping between multiple pools daily, those tiny fees add up. I’ve learned the hard way that consolidating your farming activities into fewer, more reliable pools is smarter than chasing every shiny new opportunity.

On one hand, yield farming can be lucrative and fun; on the other hand, it’s a minefield of scams and rug pulls. Actually, wait—let me rephrase that—rug pulls are rarer on Solana than on some other chains, but you still gotta be cautious. Research and trusted wallets help a lot. That’s where solflare comes in handy. It supports staking directly within the wallet, so you don’t have to shuffle through multiple dApps to manage your farms.

NFT Management: Beyond Collectibles

Here’s what bugs me about most NFT wallets—they focus so much on art display that they forget the utility side. On Solana, NFTs are evolving. Some are used for staking, others grant governance rights, and some even represent fractionalized ownership of physical assets. Managing these requires a wallet that not only shows your NFTs but also lets you interact with their smart contracts without jumping through hoops.

Hmm… at first I didn’t realize how important it was to track NFT provenance and transaction history until a friend told me about an NFT he bought that had a shady past. That made me double down on using tools that provide clear transaction trails and metadata. It’s one thing to own an NFT; it’s another to be confident in its legitimacy and potential utility.

One more thing—staking NFTs is becoming a thing. Imagine earning rewards simply by holding certain NFTs in your wallet. That was news to me until recently. The interconnection between DeFi and NFTs is tight, and managing both through a unified platform is a huge plus. Again, solflare has been stepping up with features that make NFT management feel less like a chore and more like an integrated experience.

Transaction History: Your Financial Diary

Alright, let me be frank: transaction history is often overlooked but it’s very very important. Without a clear record, you can’t track your gains, losses, or even spot suspicious activity. Some wallets give you a raw list of transactions, but that’s rarely enough. You want categorization, timestamps, fees paid, and sometimes even notes.

At first, I thought exporting CSVs from my wallet was enough. But I kept getting confused, especially when cross-referencing yield farming rewards and NFT transfers. It got messy real quick. My instinct said—there’s gotta be a better way. So I started using wallets and extensions that offer detailed, user-friendly transaction histories with filters and search.

Actually, wait—let me add that this isn’t just about convenience. Having an accurate transaction history is crucial come tax season or if you ever need to prove ownership or dispute a transaction. On Solana, where transactions are lightning fast, missing a single swap or stake can throw off your entire accounting. That’s why wallets that integrate comprehensive history tracking, like solflare, are worth their weight in SOL.

Putting It All Together: Why You Need a Wallet That Handles It All

So, why juggle multiple apps when you can streamline your whole crypto life in one place? The truth is, I’ve tried a bunch of wallets that specialize in one area but fall short elsewhere. One wallet might be great at NFT display but terrible at staking. Another has solid transaction history but clunky UI for yield farming. It’s frustrating.

That’s why I’m partial to wallets that embrace the full Solana ecosystem—staking, NFTs, and detailed transactions—and make interacting with them intuitive. It’s not just about security, which is obviously crucial, but about making complex DeFi workflows feel manageable. You don’t want to feel like you need a degree in blockchain just to check your balances.

Check this out—solflare combines these elements elegantly, and yeah, I’m biased because I’ve been using it for months now. The way it handles staking positions alongside NFT portfolios and presents a clean transaction ledger makes it easier to stay on top of my investments without losing sleep over missed opportunities or hidden fees.

Okay, I’ll admit—sometimes I just want to kick back and not worry about my crypto. But the reality is that if you’re serious about making the most out of Solana’s DeFi and NFT scene, you gotta be hands-on. And that’s way easier when your wallet doesn’t fight you every step of the way.

Frequently Asked Questions

Is yield farming on Solana profitable compared to other blockchains?

Generally, yes. Solana’s low fees and high throughput make yield farming more cost-effective, especially for smaller amounts. But profitability depends on the pools you choose and market conditions, so active management is key.

Leave a Reply

Want to join the discussion?Feel free to contribute!